Thinking of setting up your company in the UAE in 2025?

The United Arab Emirates (UAE) continues to solidify its position as a dynamic global business hub, attracting entrepreneurs, startups, and established corporations from across the globe. With its strategic location at the crossroads of East and West, a diversified economy, world-class infrastructure, and a progressive business environment, the UAE offers unparalleled opportunities for expansion and growth in 2025.

For businesses eyeing market access in the MENA region, Africa, and Asia, or simply seeking a tax-efficient and stable base for international operations, registering a company in the UAE is a compelling choice.

This ultimate guide by Helvetios.eu provides a comprehensive, step-by-step roadmap to setting up a company in the UAE in 2025. From understanding the diverse business structures (Mainland, Free Zone, Offshore) and navigating the legal landscape, to handling practical steps, costs, timelines, and crucial post-incorporation formalities—this guide is designed to empower you.

Whether you’re a local or a foreign entrepreneur, get ready to launch your UAE venture with confidence.

Why Register a Company in the UAE? Key Advantages in 2025

The UAE’s allure as a business destination is driven by a forward-thinking government and a consistent commitment to economic diversification and investor-friendly policies. While the global economic landscape evolves, the UAE remains a beacon of opportunity.

Here’s why entrepreneurs continue to choose the UAE in 2025:

Exceptional Tax Benefits

Corporate Tax Structure:

- 0% tax rate on taxable income up to AED 375,000

- 9% tax rate on taxable income above AED 375,000

- 15% Domestic Minimum Top-up Tax (DMTT) for large multinational enterprises effective January 1, 2025, aligning with OECD Pillar Two requirements

Implementation Timeline: Corporate Tax applies from the beginning of businesses’ first financial year starting on or after June 1, 2023. For calendar year businesses (January-December), this means Corporate Tax applies from January 1, 2024.

No Personal Income Tax: Individuals remain exempt from personal income tax on employment income, bank deposit interest, and personal real estate investments.

No Capital Gains or Dividend Tax: Generally, qualifying dividends and capital gains from shareholdings are exempt from Corporate Tax, particularly for businesses meeting specific criteria.

Free Zone Tax Benefits: Qualifying Free Zone businesses may maintain 0% corporate tax rates if they comply with all regulatory requirements and do not conduct business with UAE mainland, subject to existing incentive validity periods.

Extensive Double Taxation Agreements (DTAs): The UAE has a vast network of DTAs, which help businesses avoid double taxation and reduce withholding taxes on international income.

Pro-Business Government Policies

The UAE government actively promotes foreign investment through continuous reforms, streamlined processes, and dedicated support initiatives for startups and SMEs. The regulatory environment is transparent and highly digitized, especially within its numerous Free Zones.

Strategic Gateway to Global Markets

Located at the intersection of Europe, Asia, and Africa, the UAE serves as a critical trade and logistics hub. Its world-class airports and ports facilitate seamless global trade and connectivity.

Political and Economic Stability

The UAE offers a robust legal system, consistent policy environment, and strong governance, providing a secure foundation for long-term business planning and investment.

Skilled, Multilingual Workforce

Access to a highly educated, productive, and globally diverse workforce, fluent in English and other major international languages.

World-Class Infrastructure

Modern cities, state-of-the-art office spaces, advanced telecommunications, and excellent transportation networks support efficient business operations.

Ease of Doing Business

While processes vary by jurisdiction (Mainland vs. Free Zone), the UAE constantly strives to simplify company incorporation and operational procedures.

Understanding UAE Company Structures: Mainland, Free Zone, or Offshore?

Choosing the right legal entity is the foundational step in your UAE company registration process. The UAE offers three primary types of company structures, each with distinct advantages and regulations:

Mainland Company (Onshore)

Description: A company registered with the Department of Economic Development (DED) of a specific Emirate (e.g., Dubai DED, Abu Dhabi DED). It allows you to conduct business directly with the local UAE market, government entities, and across all Emirates.

Key Features:

- Historically required a 51% local sponsor/agent, but as of 2021, 100% foreign ownership is allowed in most sectors for certain company types (e.g., LLC)

- Can trade directly across the UAE and internationally

- Subject to UAE federal laws and the Corporate Tax regime (0% up to AED 375,000, 9% above)

- May be subject to 15% DMTT if part of a large multinational group

Suitability: Ideal for businesses that require a physical presence in the UAE market, wish to target local customers, engage in government contracts, or plan extensive operations within the Emirates.

Free Zone Company

Description: Companies registered within one of the UAE’s numerous special economic zones. Each Free Zone is designed to promote specific industries and offers unique incentives.

Key Features:

- 100% Foreign Ownership: This is a primary draw

- Conditional 0% Corporate Tax: Qualifying Free Zone businesses may maintain 0% corporate tax rates if they comply with all regulatory requirements and do not conduct business with UAE mainland

- 100% Repatriation of Capital and Profits: No restrictions on moving funds in or out of the country

- Industry-Specific Focus: Free Zones like DMCC (commodities), DIFC (finance), Dubai Media City (media), RAKEZ (various), SHAMS (media/creative) cater to different sectors

- Limited Trading on Mainland: Cannot directly trade on the UAE mainland without specific arrangements (e.g., through a local distributor or a mainland branch)

Suitability: Highly recommended for businesses focused on international trade, services, specific industries, or those seeking maximum foreign ownership and tax benefits. Popular choices include DMCC, JAFZA, DAFZA, DIFC, RAKEZ, and Sharjah Media City (SHAMS).

Offshore Company

Description: A company registered in specific offshore jurisdictions within the UAE (e.g., JAFZA Offshore, RAK Offshore). These entities are designed for international business activities outside the UAE.

Key Features:

- No Physical Office Requirement: Typically, no need for physical office space in the UAE

- 0% Tax: Not subject to UAE Corporate Tax

- Asset Protection & Privacy: Often used for holding assets, intellectual property, or for international trading

- No Local Trading: Cannot conduct business within the UAE mainland or Free Zones

Suitability: Best for international trading, holding companies, real estate ownership (outside UAE), and professional services that do not require a physical presence or local clients in the UAE.

| Structure | Mainland Company | Free Zone Company | Offshore Company |

| Registration | DED of Emirate | Free Zone Authority | Offshore Registrar |

| Ownership | 100% foreign allowed in most sectors since 2021 | 100% foreign ownership | 100% foreign ownership |

| Taxation | 0% up to AED 375,000, 9% above + potential 15% DMTT | 0% for qualifying entities | 0% (not subject to UAE tax) |

| Local Trading | Allowed | Not allowed (unless via agent/distributor) | Not allowed |

| Office Requirement | Physical office required | Physical or flexi-desk | No physical office |

Step-by-Step Guide: How to Register a Company in UAE (2025)

The company registration process in the UAE is streamlined, particularly with the assistance of a professional service provider like Helvetios.eu. The specific steps and timelines can vary slightly depending on whether you choose a Mainland, Free Zone, or Offshore setup.

Here’s a general roadmap:

- Choose Your Business Activity & Structure:

- Define your primary business activities (e.g., consulting, trading, IT services). This determines your license type.

- Decide between Mainland, Free Zone, or Offshore based on your business model, target market, and ownership preferences.

Helvetios.eu provides initial consultation to help you make this critical decision.

- Select a Company Name:

- Your proposed company name must be unique, not violate public morality, and adhere to naming conventions (e.g., no offensive words, no religious/political references, no abbreviations unless part of the name).

- The name must be reserved with the relevant authority (DED for Mainland, or the specific Free Zone authority).

- Choose Your Business Location/Office Space:

- Mainland: Requires a physical office space that meets DED requirements.

- Free Zone: Requires a physical office, which can range from a flexi-desk/co-working space to a dedicated office, depending on your visa and activity needs. Virtual office solutions are often available within Free Zones for minimal presence.

- Offshore: No physical office space is typically required.

- Appoint Local Service Agent / Local Sponsor (for Mainland, if applicable):

- For Mainland LLCs, 100% foreign ownership is now generally allowed in most sectors, eliminating the need for a local sponsor (UAE national owning 51%).

- However, some business activities or professional licenses might still require a Local Service Agent (LSA) for administrative purposes, who does not hold shares. Your chosen business activity will determine this.

- Helvetios.eu will advise you on the specific requirements for your chosen Mainland activity.

- Prepare Essential Documents:

- Passport copies of all shareholders, directors, and managers.

- Residency visa copies (if applicable).

- NOC (No Objection Certificate) from current employer/sponsor if employed in the UAE.

- Business plan (sometimes required for specific Free Zones or visas).

- Utility bill/Proof of Address (for individuals).

- Company documents (for corporate shareholders/directors).

- Submit Application & Obtain Initial Approval:

- Your chosen consultant (e.g., Helvetios.eu) will submit the application to the relevant authority (DED or Free Zone authority).

- This step involves reviewing your business activity, proposed name, and initial documents.

- Secure Office Space / Lease Agreement:

- Once initial approval is granted, you will need to finalize your office lease agreement (Ejari for Mainland, or direct lease with the Free Zone). This is crucial for obtaining your trade license.

- Get Final Approval & Trade License:

- After all requirements are met and documents are submitted, the authority will issue your Trade License. This is your official permission to operate in the UAE.

- You will also receive your Memorandum of Association (MOA) and Articles of Association (AOA).

- Corporate Tax Registration

Businesses subject to Corporate Tax must register with the Federal Tax Authority (FTA) before their financial year deadline to avoid penalties This applies to businesses with financial years starting on or after June 1, 2023

- Open a Corporate Bank Account

- This is a crucial post-incorporation step. Major banks in the UAE (e.g., Emirates NBD, Mashreq, HSBC, Standard Chartered) offer corporate accounts

- Requirements: Typically include the Trade License, MOA/AOA, company resolution, proof of directors’/shareholders’ identities, and sometimes a business plan

- Challenges for Foreigners: Some banks may require directors/signatories to be physically present in the UAE for identity verification, or they might accept video calls or certified documents. Helvetios.eu can guide you through bank selection and application to find the best fit and assist with introductions

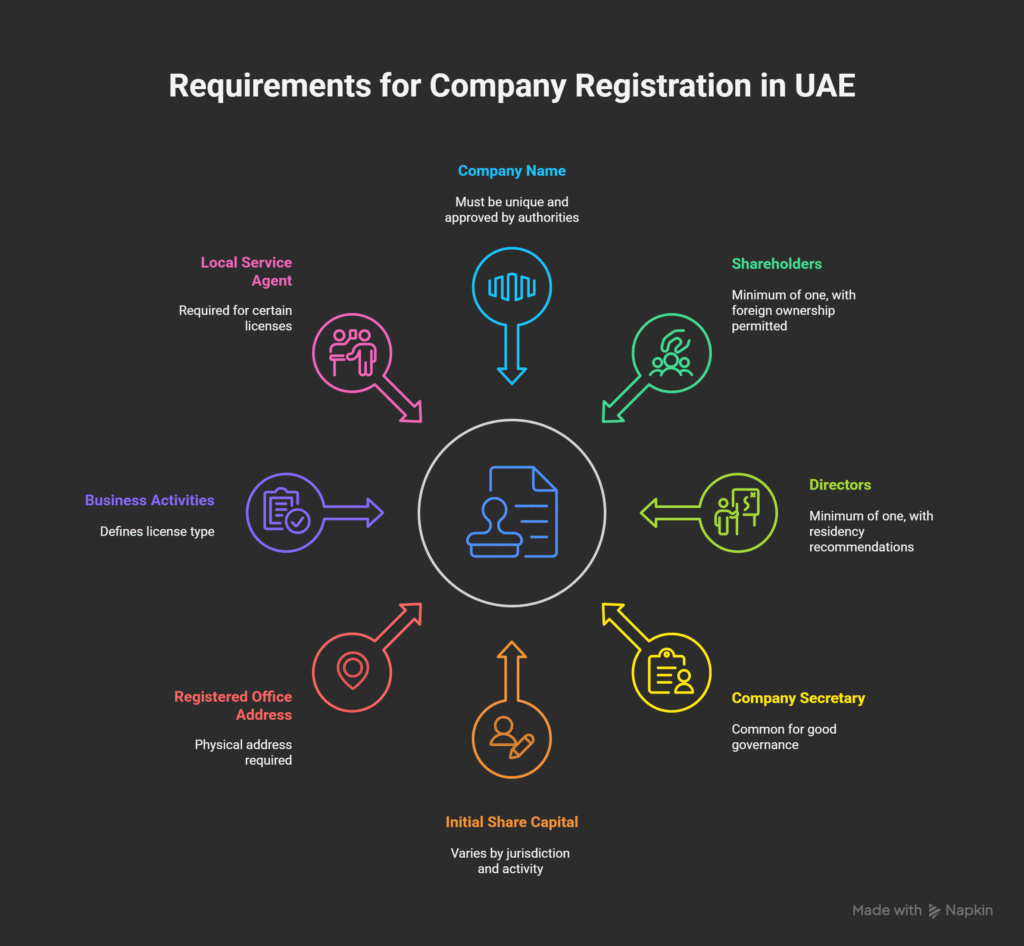

Key Requirements for Company Registration in UAE (Detailed Checklist)

Ensuring you meet the fundamental requirements is key to a smooth incorporation process. These are general requirements for the most common company types (e.g., LLC):

- Company Name: Must be unique and approved by the relevant authority.

- Shareholders: Minimum of one (individual or corporate). 100% foreign shareholding is permitted in most sectors.

- Directors: Minimum of one director. A resident director is usually not mandatory for Free Zone or Offshore companies but recommended for Mainland to facilitate certain banking processes.

- Company Secretary: Not always mandatory for all company types, but common practice to appoint one for good governance.

- Initial Share Capital: Minimum share capital requirements vary by jurisdiction and activity (e.g., some Free Zones have AED 50,000 or 150,000, while for Mainland LLCs it can be as low as AED 1 but often advised to have more for banking).

- Registered Office Address: A physical street address in the UAE (P.O. Box is not allowed for most company types). Virtual office solutions are acceptable in many Free Zones.

- Business Activities (License): Defined by the specific activities you plan to undertake, which determine your license type.

- Local Service Agent (LSA): For certain Mainland professional licenses, an LSA (UAE National) might still be required for administrative purposes, but without shareholding.

How to Open a Company in UAE as a Foreigner

The UAE actively encourages foreign investment. You primarily have two routes as a foreign entrepreneur:

- Engage a Professional Corporate Service Provider (Recommended):

- This is the most common and efficient method for foreigners, especially if you do not plan to physically relocate to the UAE initially.

- A professional firm like Helvetios.eu will handle all aspects of registration, liaise with government authorities, prepare documents, and ensure compliance.

- They can assist with nominee director services if required (though less common now with 100% foreign ownership), and guide you through the bank account opening process.

- Helvetios.eu specializes in remote company setup for foreigners, ensuring a smooth and compliant process from anywhere in the world. You can manage your company remotely.

- Relocate to the UAE & Obtain a Resident Visa:

- If you plan to live and work in the UAE, you (as a shareholder/director) can apply for a relevant resident visa (e.g., Investor Visa, Employment Visa) through your newly formed company.

- Investor Visa: For business owners who invest in their UAE company.

- Employment Visa: For individuals hired by a UAE company (either their own or another).

Helvetios.eu can assist with the visa application process as part of your company setup package.

What Happens After Company Incorporation in UAE? (Post-Incorporation Formalities)

Company registration is just the first step. Post-incorporation, several crucial formalities ensure your company remains compliant and operational. Helvetios.eu offers comprehensive post-incorporation support to keep your business on track.

- Open Corporate Bank Account: As detailed above, this is critical for business operations.

- Apply for Business-Specific Licenses/Permits: Depending on your industry (e.g., financial services, education, healthcare, F&B), you may need additional specific licenses or approvals from relevant government agencies.

- Employee Visas & Labour Cards (if applicable): If you plan to hire employees (local or foreign), you’ll need to apply for their visas, labour cards, and Emirates IDs through the Ministry of Human Resources & Emiratisation (MoHRE) and the General Directorate of Residency and Foreigners Affairs (GDRFA).

- VAT Registration (if applicable): If your projected annual taxable supplies and imports exceed AED 375,000, you must register for Value Added Tax (VAT) with the Federal Tax Authority (FTA). Voluntary registration is available for businesses with annual taxable supplies and imports exceeding AED 187,500.

- Set Up Accounting System & Bookkeeping: Maintain proper financial records from day one to ensure compliance with UAE accounting standards.

Helvetios.eu provides expert accounting and bookkeeping services.

Compliance Requirements

Economic Substance Regulations (ESR) Compliance: Companies undertaking certain “Relevant Activities” (as defined by UAE law) must demonstrate adequate economic substance in the UAE. This includes maintaining adequate physical presence, conducting core income-generating activities in the UAE, and having sufficient qualified personnel.

Helvetios.eu can advise on ESR compliance.

Ultimate Beneficial Ownership (UBO) Declaration: Companies must file UBO data with the relevant registrar, maintaining transparency about ultimate owners. This includes identifying individuals who ultimately own or control the company through ownership of shares, voting rights, or other means.

Ongoing Formalities & Filing Requirements in UAE

Maintaining good standing with the relevant authorities (DED, Free Zone authority, FTA, MoHRE, etc.) is critical. Helvetios.eu provides ongoing administration and compliance services to ensure your UAE company meets all its obligations.

- Annual License Renewal: Your trade license must be renewed annually. This typically involves renewing your office lease and submitting updated documents.

- Annual Audit & Financial Statements (if applicable): While not all companies are required to submit audited financials to the DED or Free Zone authorities annually (especially for Free Zone companies without specific thresholds), it’s often a good practice and may be required by banks.

- Corporate Tax Filing: Companies subject to the new corporate tax regime must file their tax returns annually with the Federal Tax Authority (FTA).

- VAT Filing: If VAT-registered, you must file VAT returns periodically (usually quarterly) with the FTA.

- Maintaining Statutory Registers: Keep internal records of shareholders, directors, and managers up to date.

- ESR & UBO Compliance: Ongoing monitoring and reporting, if applicable.

How Long Does It Take to Register a Company in UAE?

The actual incorporation process in the UAE can be remarkably fast once all documents are prepared and requirements are met. The overall timeline depends on the chosen structure and your efficiency in providing documents.

- Mainland Company: Typically 2-5 working days for license issuance after all approvals (trade name, initial approval, etc.) and lease agreement are in place. The whole process, including approvals, can take 1-2 weeks.

- Free Zone Company: Often the fastest option, with incorporation taking as little as 1-3 working days once all documents are ready and submitted. Some Free Zones boast same-day or 24-hour setup.

- Offshore Company: Can also be quite quick, often within 2-5 working days.

Overall Timeline: Including initial consultation, document preparation, name approval, license issuance, and setting up a corporate bank account, the entire process can often be completed within 1 to 3 weeks with efficient service from a firm like Helvetios.eu. We pride ourselves on our swift and reliable company formation services, getting your business ready to operate faster.

Important Disclaimers and Notes

Tax Regulation Updates: UAE tax regulations are subject to change. The information provided is based on current laws as of 2025. Always consult with qualified tax professionals and refer to official government sources for the most current information.

Professional Advice: While this guide provides comprehensive information, each business situation is unique. Professional consultation is recommended to ensure compliance with all applicable laws and regulations.

Government Sources: This guide is based on information from official UAE government sources including the Ministry of Finance, Federal Tax Authority, and UAE Official Portal.

Ready to Start Your UAE Company?

Helvetios makes it fast, secure, and fully compliant to register a company in the UAE—wherever you are in the world. From choosing the right structure and setting up banking to ensuring ongoing compliance, our experts handle it all.

👉 Contact us now to book your free consultation and launch your UAE venture in days, not weeks!