Portugal is now a top choice for European business expansion. Its strategic location, attractive tax environment, and growing economy provide abundant opportunities for company registration.

Explore this comprehensive guide for Portugal company registration steps and benefits. Understanding the nuances of the Portuguese business landscape ensures a smooth launch for any business.

This article gives you a clear roadmap, guiding you from choosing the right legal structure to handling tax obligations.

Why Register Your Company in Portugal?

Portugal offers a compelling package of advantages for both EU and non-EU entrepreneurs. Here are some of the primary benefits:

- Gateway to the European Market: The EU single market, which Portuguese companies gain full access to, represents over 450 million consumers and a GDP of around €15 trillion. (Eurostat, European Commission official website.)

- Favorable Tax Environment: Portugal offers competitive corporate tax rates. The standard corporate income tax (CIT) rate is 21%. Small and Medium-sized Enterprises (SMEs) can benefit from a reduced CIT rate of 16% on the first €50,000 of taxable income (as of 2025). Portugal offers an extensive network of double taxation treaties, helping your business avoid paying tax twice on the same income.

- Attractive Holding Company Regime: Portugal is an appealing location for establishing holding companies due to its participation exemption regime, which can exempt dividends and capital gains from taxation under certain conditions.

- Skilled and Multilingual Workforce: Portugal boasts a well-educated and increasingly multilingual talent pool, particularly strong in areas like technology, engineering, and creative industries. According to the EF English Proficiency Index 2024, Portugal ranks 6th globally for English proficiency, often surpassing countries like Germany and France. (EF English Proficiency Index.)

- Improving Business Environment: The Portuguese government has made significant efforts to simplify the company registration process and reduce bureaucracy, making it more business friendly. Portugal was ranked the 7th most attractive country in Europe for FDI in 2024, according to the EY Europe Attractiveness Survey.

- Quality of Life and Location: Beyond business, Portugal offers a high quality of life, relatively lower living costs compared to other Western European countries, political stability, and excellent infrastructure, including a modern telecommunications network and transportation links. Its strategic geographic location also provides easy access to Africa and the Americas.

- Potential for Residency: If you’re a non-EU citizen, forming a company in Portugal can open a path to residency—either through the D7 Visa (for those with passive income) or through investment activities under the Golden Visa program. Be sure to review the latest regulations, as requirements may change.

Steps to Register Your Company in Portugal

Registering a company in Portugal involves a series of steps. Although the process is more straightforward now, you must still follow the correct procedures carefully. Here is a general outline:

Choose Your Company Name and Obtain a Certificate of Admissibility (Certificado de Admissibilidade):

- You need to select a unique company name. You can check for availability and apply for a name approval certificate through the National Registry of Collective Persons (Registo Nacional de Pessoas Colectivas – RNPC).

- The certificate confirms the availability and admissibility of your chosen name and proposed business object (the company’s activities).

Define the Share Capital and Open a Provisional Bank Account:

- For an LDA (private limited company), the minimum share capital is €1 per quotaholder, with a higher practical total recommended. For a public limited company (SA – Sociedade Anónima), the minimum share capital is €50,000.

- A provisional bank account must be opened in the company’s name, and the initial share capital deposited. This step often requires the future partners/shareholders to have a Portuguese Tax Identification Number (NIF).

Obtain Portuguese Tax Identification Numbers (NIF) and Social Security Numbers:

- All founders, partners, and directors will need a Portuguese NIF. Non-residents can obtain a NIF by appointing a tax representative in Portugal.

- You also need to register with Social Security.

Draft the Articles of Association (Pacto Social/Estatutos):

- This is a crucial legal document outlining the company’s structure, objectives, share capital division, administration rules, and the rights and obligations of the partners/shareholders. It must be drafted in Portuguese.

Sign the Public Deed of Incorporation:

- The founders must sign the public deed of incorporation before a notary or at a “Empresa na Hora” (Company in the Hour) service point. The Empresa na Hora service offers a simplified and faster registration process for certain types of companies using pre-approved articles of association.

Register the Company with the Commercial Registry (Conservatória do Registo Comercial):

- After signing the public deed, register the company with the competent Commercial Registry. This step officially brings the company into legal existence.

Declare the Commencement of Activity (Declaração de Início de Actividade):

- Within a specified period after registration, the company must declare the commencement of its activity with the Portuguese Tax Authority (Autoridade Tributária e Aduaneira).

Register with Social Security:

- Make sure you register both the company and its employees with Social Security.

Obtain Any Necessary Licenses and Permits:

- Depending on the nature of your business activities, you may need to obtain specific licenses, permits, or authorizations from relevant authorities.

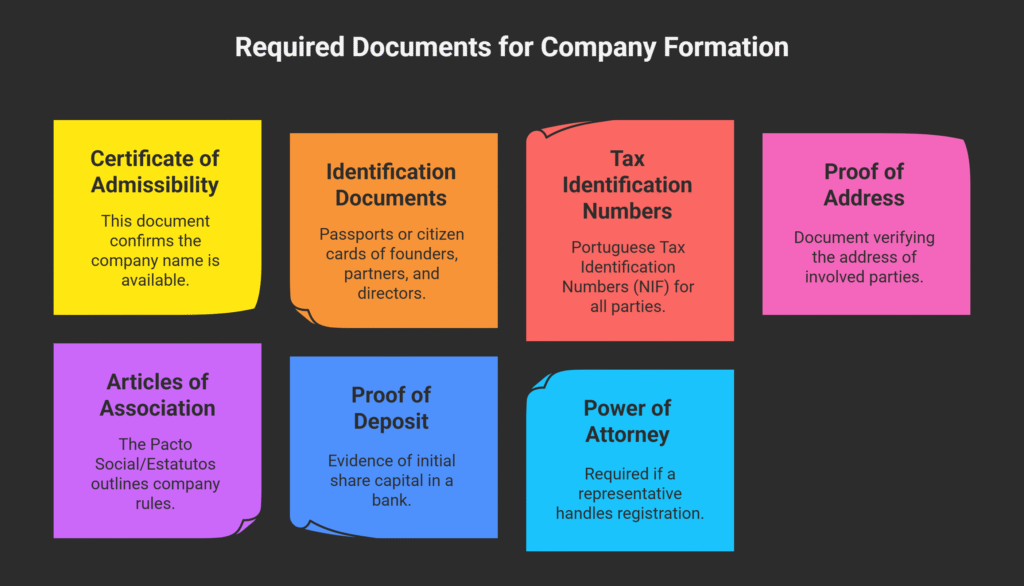

Required Documents

While the specific documents may vary depending on the type of company and the nationality of the founders, common requirements include:

- Certificate of Admissibility (Certificado de Admissibilidade).

- Identification documents of the founders/partners/directors (Passport orCitizen Card).

- Portuguese Tax Identification Numbers (NIF) for all involved parties.

- Proof of address.

- Articles of Association (Pacto Social/Estatutos).

- Proof of deposit of the initial share capital in a Portuguese bank account.

- Power of Attorney if the registration is done by a representative.

Timeline for Registration

The time it takes to register a company in Portugal can vary depending on the method you choose. With the “Empresa na Hora” service, registration can be completed in as little as 24 hours — as long as all your documents are ready and your business type qualifies.

If you go the traditional route, expect the process to take anywhere from a few days to a couple of weeks, depending on the workload of the Commercial Registry and how complex your company structure is. Keep in mind, though, that you’ll also need to factor in extra time for steps like obtaining tax numbers (NIFs), opening a business bank account, and preparing your company’s articles of association. These can all extend the overall timeline.

Choosing the Right Legal Structure

The most common legal structures for businesses in Portugal are:

- Sociedade por Quotas (Lda.): A private limited company, similar to an LLC. This is a popular choice for small and medium-sized businesses due to its flexibility and lower minimum capital requirement (€1 per quotaholder). The liability of the partners is limited to their capital contributions.

- Sociedade Anónima (S.A.): A public limited company, similar to a PLC. This structure is typically used for larger businesses that intend to raise capital from the public. It requires a minimum share capital of €50,000 and has more complex governance requirements.

- Empresário em Nome Individual: A sole trader or sole proprietorship. This is the simplest form, where there is no legal distinction between the owner and the business.

- Estabelecimento Individual de Responsabilidade Limitada (EIRL): An individual limited liability establishment. This allows a single individual to set up a business with limited liability, separating their personal assets from the business’s debts.

The choice of legal structure depends on factors such as the number of founders, the planned scale of operations, capital requirements, and desired level of liability.

Tax Obligations in Portugal

Once you register and start operating your company in Portugal, you must comply with Portuguese tax laws. Key taxes include:

- Corporate Income Tax (CIT): The standard rate is 21%, with a reduced rate for SMEs on the first €50,000 of taxable income.

- Value Added Tax (VAT – IVA): The standard VAT rate in mainland Portugal is currently 23%, with reduced rates for certain goods and services.

- Social Security Contributions: Both employers and employees are required to make contributions to social security.

- Other potential taxes: Depending on the business activity, other taxes such as stamp duty or property taxes may apply.

It is highly recommended to seek advice from a qualified accountant or tax advisor in Portugal to ensure full compliance with local tax regulations.

How Helvetios Can Help

Navigating the process of company registration in a foreign country can be complex and time-consuming. This is where Helvetios provides invaluable expertise and support. Our team is experienced in Portuguese company law and administration, offering a streamlined and efficient service to help you establish your business.

We assist with:

- Choosing the optimal legal structure for your specific business needs and goals.

- Handling the entire registration process, including name approval, drafting articles of association, and liaising with the Commercial Registry and Tax Authority.

- Obtaining necessary tax and social security numbers for founders and the company.

- Opening a corporate bank account, navigating the requirements for non-residents.

- Providing registered office services if needed.

- Offering ongoing accounting, tax, and legal compliance support once your company is registered.

With Helvetios, you benefit from expert guidance, reduced bureaucracy, and a faster path to getting your Portuguese company operational.

Portugal Company Registration FAQs 2025

Why should I register my company in Portugal?

Portugal offers numerous advantages including access to the EU single market (450+ million consumers, €15 trillion GDP), favorable tax environment with 21% corporate tax rate (16% for SMEs on first €50,000), attractive holding company regime, skilled multilingual workforce, and improved business environment. Portugal ranks 7th most attractive country in Europe for FDI according to the 2024 EY Europe Attractiveness Survey.

What makes Portugal attractive for international businesses?

Portugal provides strategic access to European, African, and American markets due to its geographic location. The country offers political stability, high quality of life, lower living costs compared to other Western European countries, and excellent infrastructure including modern telecommunications and transportation networks.

Can non-EU citizens register companies in Portugal?

Yes, non-EU citizens can register companies in Portugal. Additionally, company formation can open pathways to residency through the D7 Visa (for passive income holders) or investment activities under the Golden Visa program, though requirements may change so it’s important to review current regulations.

What are the corporate tax rates in Portugal?

- Standard Corporate Income Tax (CIT): 21%

- SME Reduced Rate: 16% on the first €50,000 of taxable income for Small and Medium-sized Enterprises

- Double Taxation Treaties: Portugal has an extensive network to help avoid paying tax twice on the same income

What is Portugal’s holding company regime?

Portugal offers an attractive holding company regime with a participation exemption that can exempt dividends and capital gains from taxation under certain conditions, making it appealing for international corporate structures.

What other taxes will my company face?

- Value Added Tax (VAT/IVA): 23% standard rate in mainland Portugal with reduced rates for certain goods/services

- Social Security Contributions: Required for both employers and employees

- Other taxes: Depending on business activity, may include stamp duty or property taxes

What are the main company types available in Portugal?

- Sociedade por Quotas (Lda.): Private limited company, popular for SMEs with €1 minimum capital per quotaholder

- Sociedade Anónima (S.A.): Public limited company for larger businesses, €50,000 minimum capital

- Empresário em Nome Individual: Sole trader/proprietorship, simplest form

- EIRL: Individual limited liability establishment for single-person businesses with limited liability

Which company structure should I choose?

The choice depends on:

- Number of founders

- Planned scale of operations

- Capital requirements

- Desired level of liability protection

- Future growth and investment plans

What is the minimum capital requirement?

- Lda. (Private Limited): €1 per quotaholder (though higher amounts are recommended practically)

- S.A. (Public Limited): €50,000 minimum share capital

- Sole Trader: No minimum capital requirement

- EIRL: No specific minimum capital requirement

What are the main steps to register a company in Portugal?

- Choose company name and obtain Certificate of Admissibility

- Define share capital and open provisional bank account

- Obtain Portuguese Tax Identification Numbers (NIF) and Social Security Numbers

- Draft Articles of Association in Portuguese

- Sign Public Deed of Incorporation

- Register with Commercial Registry

- Declare commencement of activity with Tax Authority

- Register with Social Security

- Obtain necessary licenses and permits

How long does company registration take?

- “Empresa na Hora” service: As little as 24 hours for qualifying companies with all documents ready

- Traditional route: Few days to a couple of weeks depending on Commercial Registry workload and company complexity

- Additional time needed: For obtaining NIFs, opening bank accounts, and preparing articles of association

What is the “Empresa na Hora” service?

“Empresa na Hora” (Company in the Hour) is a simplified and faster registration process for certain types of companies using pre-approved articles of association. It can complete registration in as little as 24 hours.

What documents do I need for company registration?

- Certificate of Admissibility (Certificado de Admissibilidade)

- Identification documents (Passport or Citizen Card) for all founders/partners/directors

- Portuguese Tax Identification Numbers (NIF) for all parties

- Proof of address

- Articles of Association (Pacto Social/Estatutos) in Portuguese

- Proof of initial share capital deposit in Portuguese bank account

- Power of Attorney if using a representative

Do I need a Portuguese Tax Number (NIF)?

Yes, all founders, partners, and directors need a Portuguese NIF. Non-residents can obtain a NIF by appointing a tax representative in Portugal.

Can I use a representative for registration?

Yes, you can use a representative for registration, but you’ll need to provide a Power of Attorney for them to act on your behalf.

Do I need to open a Portuguese bank account?

Yes, you must open a provisional bank account in the company’s name and deposit the initial share capital before registration. This often requires having a Portuguese NIF.

Can non-residents open Portuguese bank accounts?

Yes, but it may require additional documentation and procedures. Having a tax representative or using professional services can help navigate the requirements.

When do I need to deposit the share capital?

The initial share capital must be deposited in the provisional bank account before signing the Public Deed of Incorporation.

What language advantages does Portugal offer?

Portugal ranks 6th globally for English proficiency according to the EF English Proficiency Index 2024, often surpassing countries like Germany and France. The country has a well-educated, multilingual workforce particularly strong in technology, engineering, and creative industries.

Are there language requirements for business documents?

Yes, the Articles of Association must be drafted in Portuguese. Other official documents typically need to be in Portuguese or officially translated.

Do I need special licenses for my business?

Depending on your business activities, you may need specific licenses, permits, or authorizations from relevant authorities. This varies by industry and business type.

What ongoing compliance requirements exist?

- Annual tax filings with Portuguese Tax Authority

- Social Security registrations and contributions

- VAT filings if applicable

- Maintaining proper corporate records

- Annual reporting to Commercial Registry

When must I declare commencement of activity?

You must declare the commencement of activity with the Portuguese Tax Authority (Autoridade Tributária e Aduaneira) within a specified period after company registration.

Should I use professional services for registration?

Yes, navigating Portuguese company registration can be complex, especially for foreign entrepreneurs. Professional services can help with:

- Choosing optimal legal structure

- Handling entire registration process

- Obtaining necessary tax and social security numbers

- Opening corporate bank accounts

- Providing registered office services

- Ongoing compliance support

What services does Helvetios provide?

Helvetios offers comprehensive support including:

- Legal structure selection guidance

- Complete registration process handling

- Name approval and articles of association drafting

- Tax and social security number procurement

- Corporate bank account opening assistance

- Registered office services

- Ongoing accounting, tax, and legal compliance support

Can I complete the registration remotely?

While some steps can be handled remotely, certain procedures like signing the Public Deed of Incorporation typically require physical presence or proper legal representation in Portugal.

What market access does a Portuguese company provide?

Portuguese companies gain full access to the EU single market representing over 450 million consumers and approximately €15 trillion GDP, plus strategic access to African and American markets through Portugal’s geographic position and historical connections.

Is Portugal business-friendly for startups?

Yes, the Portuguese government has made significant efforts to simplify company registration processes and reduce bureaucracy. The country offers various support programs and has an improving business environment for entrepreneurs.

What industries are strongest in Portugal?

Portugal has particular strengths in technology, engineering, creative industries, tourism, renewable energy, and traditional sectors like textiles and footwear. The country is also developing fintech and digital innovation sectors.

What are the typical costs for company registration?

Costs vary depending on company type, professional services used, and specific requirements. This includes registration fees, notary fees, initial capital deposit, and potential professional service fees.

How can I speed up the registration process?

- Use the “Empresa na Hora” service if eligible

- Have all documents prepared in advance

- Obtain NIFs early in the process

- Use professional services familiar with Portuguese procedures

- Choose standard company structures rather than complex customizations